MANDATE

- To collect taxes, fees and other revenues

- Take custody and exercise proper management of the funds of the Local Government Unit concerned;

- Take charge of the disbursement of all Local Government funds entrusted to him/her by law;

- Inspect private commercial and industrial establishment in relation to the implementation of tax ordinances and

- Maintain and update the tax information system of the Local Government Unit

VISION

With deep commitment in attaining its vision, the Treasurer’s Office, as a frontliner in the entire Local Government Unit, shall vigorously pursue its mandates to the highest degree of efficiency, the utilization of government monies to uplift the socio-economic growth for LGU City of Naga, Cebu, Philippines.

MISSION

- To ensure efficient and effective collection of taxes which is just and fair to taxpayers

- To maximize tax revenue collection which has the greatest potential in achieving local fiscal self sufficiency

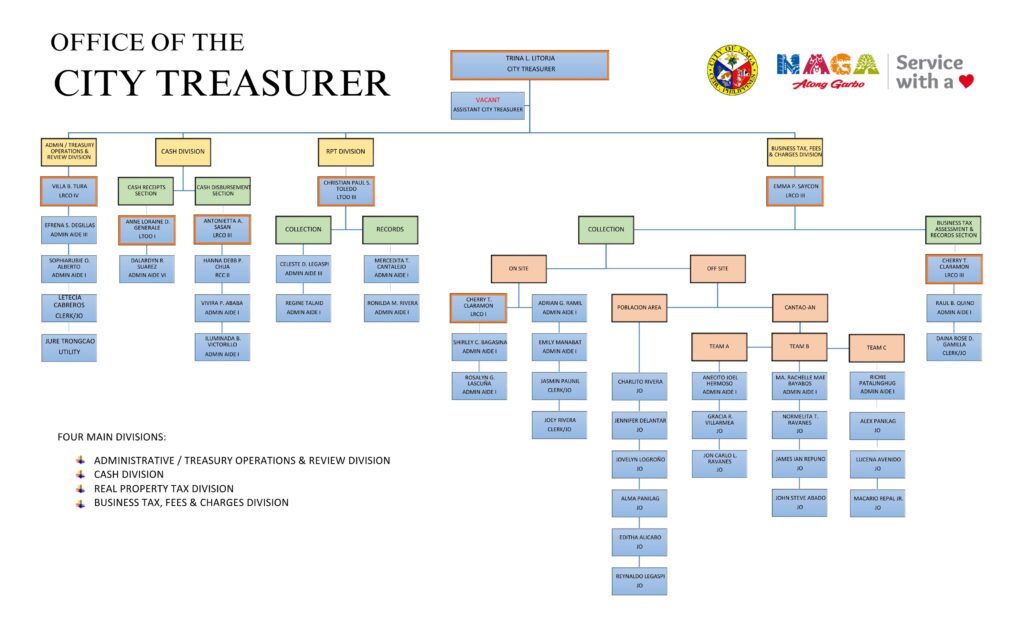

Office of the City Treasurer

External Services

1. Payment of Real Property Tax

Ad Valorem Tax – Levy on Real Property Tax

Office or Division: Office of the City Treasurer (CTO) – Cashier Section

Classification: Simple

Type of Transaction: G2B, G2C

Who may avail: Declared owners, business entities/persons having legal interests, rights, or participation in the property

Checklist of Requirements:

- Latest Notice of Assessment and Tax Bill (NATB) – Where to Secure: City Assessor

- Last real property tax official receipt – Where to Secure: Client

Client Steps & Agency Actions:

| Client Steps | Agency Actions | Fees to Be Paid | Processing Time | Person Responsible |

|---|---|---|---|---|

| 1. Present the Notice of Assessment and Tax Bill (NATB) and the official receipt | 1. Receive the document and compute/assess the tax dues | Computation (Annual tax due: P11,000.00) | 5 minutes | Cashier CTO |

| 2. Pay the computed Real Property Tax dues | 2. Receive payment and issue corresponding official receipt | Base on Computation (P11,000.00) | 5 minutes | Cashier CTO |

Total Processing Time: 10 minutes

2. Tax on Transfer of Real Property Ownership

Office or Division: Office of the City Treasurer (CTO) – Cashier Section

Classification: Simple

Type of Transaction: G2B, G2C

Who may avail: Declared owners, business entities/persons having legal interests, rights, or participation in the property

Checklist of Requirements:

- Latest Notice of Assessment and Tax Bill (NATB) – Where to Secure: City Assessor

- Deed of Sale – Where to Secure: Client

- Extra Judicial Declaration of Heirs – Where to Secure: Client

Client Steps & Agency Actions:

| Client Steps | Agency Actions | Fees to Be Paid | Processing Time | Person Responsible |

|---|---|---|---|---|

| 1. Present the NATB and official receipt along with the Deed of Sale or other relevant documents | 1. Compute the real property transfer tax | Transfer tax (Example: P500.00) | 5 minutes | Cashier CTO |

| 2. Pay the transfer tax due | 2. Receive payment and issue official receipt | P500.00 | 5 minutes | Cashier CTO |

Total Processing Time: 10 minutes

3. Payment of Business Tax

Office or Division: Office of the City Treasurer (CTO) – Cashier Section

Classification: Simple

Type of Transaction: G2B

Who may avail: Businesses in the City of Naga, Cebu

Checklist of Requirements:

- Barangay Clearance – Where to Secure: Barangay Hall

- Capitalization (New Applicant) / Statement of Gross Receipts (Renewal) – Where to Secure: Declared owner or applicant

- CDA, SEC registration, Inspection Report, etc. – Where to Secure: Various agencies

Client Steps & Agency Actions:

| Client Steps | Agency Actions | Fees to Be Paid | Processing Time | Person Responsible |

|---|---|---|---|---|

| 1. Submit business application form for verification and assessment | 1. Receive documents and check completeness | None | 3 minutes | Cashier CTO |

| 2. Pay the computed business tax | 2. Receive payment and issue official receipt | Based on computation (e.g., P11,000.00) | 5 minutes | Cashier CTO |

Total Processing Time: 30 minutes

4. Issuance of Community Tax Certificate (Individual)

Office or Division: Office of the City Treasurer (CTO) – Cashier Section

Classification: Simple

Type of Transaction: G2C

Who may avail: All City of Naga, Cebu residents

Checklist of Requirements:

- Barangay Clearance – Where to Secure: Barangay Hall (client’s residence)

- Government-issued valid ID – Where to Secure: Various agencies

- Community Tax Declaration Form (CTDF) – Where to Secure: Cashier Division

Client Steps & Agency Actions:

| Client Steps | Agency Actions | Fees to Be Paid | Processing Time | Person Responsible |

|---|---|---|---|---|

| 1. Submit the requirements and accomplish the CTDF | 1. Check the validity of documents and encode data | Basic: P5.00 + Additional tax | 8 minutes | Cashier CTO |

| 2. Pay the computed amount | 2. Receive payment and print CTC | Tax due (e.g., P105.00) | 2 minutes | Cashier CTO |

Total Processing Time: 10 minutes

5. Issuance of Community Tax Certificate (Corporation)

Office or Division: Office of the City Treasurer (CTO) – Cashier Section

Classification: Simple

Type of Transaction: G2B

Who may avail: All City of Naga, Cebu business owners or taxpayers

Checklist of Requirements:

- Approved Business Permit Application / Renewal Form – Where to Secure: BPLO

- Articles of Incorporation, SEC Registration – Where to Secure: Securities and Exchange Commission

Client Steps & Agency Actions:

| Client Steps | Agency Actions | Fees to Be Paid | Processing Time | Person Responsible |

|---|---|---|---|---|

| 1. Submit the required documents for computation | 1. Compute the tax based on business gross sales | Basic: P500.00 + Additional tax | 3 minutes | Cashier CTO |

| 2. Pay the computed amount | 2. Collect payment and issue CTC | Based on computed tax (e.g., P580.00) | 3 minutes | Cashier CTO |

Total Processing Time: 8 minutes

6. Issuance of Real Property Tax Clearance

Office or Division: Office of the City Treasurer (CTO) – Real Property Division

Classification: Simple

Type of Transaction: G2C, G2B

Who may avail: Property owners or their authorized representatives

Checklist of Requirements:

- Tax Clearance Order of Payment Form – Where to Secure: CTO – Real Property Division

- Latest NATB, Photocopy of Tax Declaration, Latest Official Receipt, etc. – Where to Secure: Various offices

Client Steps & Agency Actions:

| Client Steps | Agency Actions | Fees to Be Paid | Processing Time | Person Responsible |

|---|---|---|---|---|

| 1. Submit documentation | 1. Verify documents and assess property tax status | P50.00 per tax declaration | 5 minutes | Admin Aide or JO Staff |

| 2. Pay the order of payment | 2. Accept payment and issue official receipt | As per assessment | 3 minutes | Cashier CTO |

Total Processing Time: 18 minutes

7. Payment of Building Permit/Electrical, Certificate of Occupancy, Zoning Permit Fees

Office or Division: Office of the City Treasurer (CTO) – Cashier Section

Classification: Simple

Type of Transaction: G2B, G2C

Who may avail: Taxpayers or authorized representatives

Checklist of Requirements:

- Assessment Form/Order of Payment – Where to Secure: Office of the Building Official

Client Steps & Agency Actions:

| Client Steps | Agency Actions | Fees to Be Paid | Processing Time | Person Responsible |

|---|---|---|---|---|

| 1. Present the assessment form | 1. Receive the form and check for completeness | Amount depends on taxpayer’s income | 2 minutes | Cashier CTO |

| 2. Pay the amount and receive OR | 2. Collect payment and issue OR | As per assessment form | 3 minutes | Cashier CTO |

Total Processing Time: 7 minutes